44+ how much of my income should go to mortgage

Most of the land mass of the nation outside of large cities qualify for USDA. Maximum allowable income is 115 of local median income.

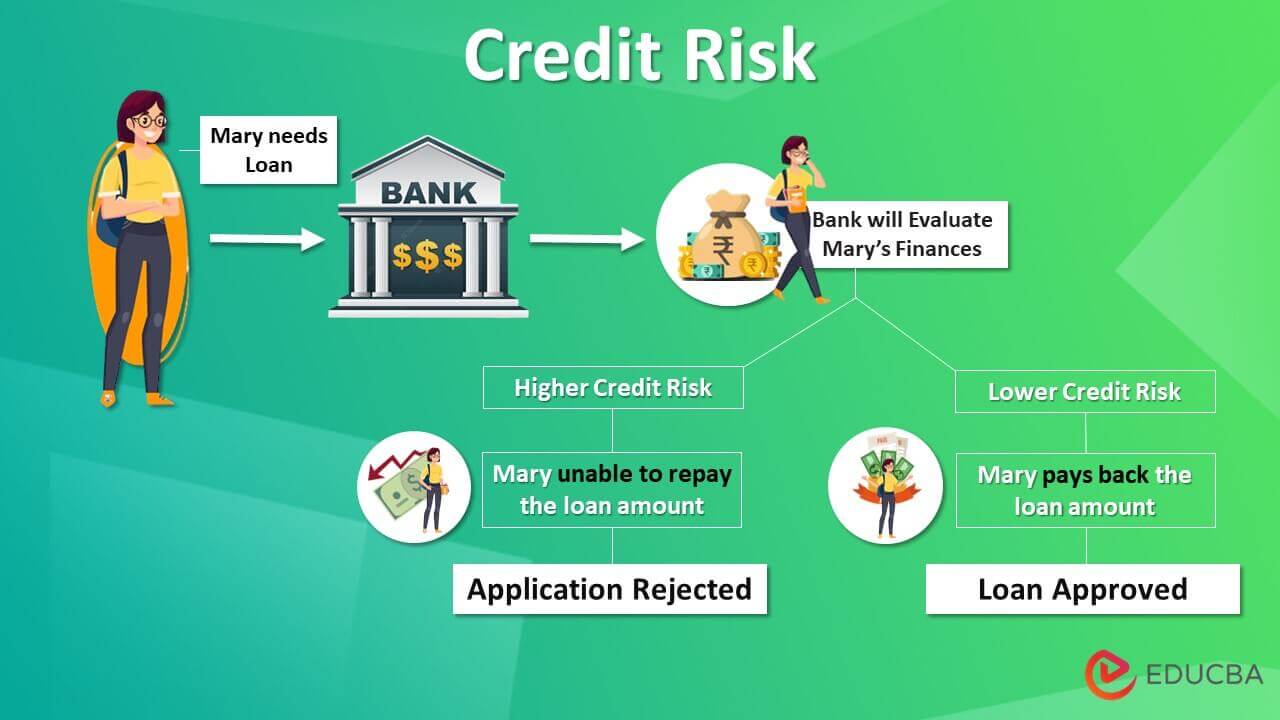

Credit Risk How To Measure Credit Risk With Types And Uses

Web 25 Post-Tax Model.

. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. With a Low Down Payment Option You Could Buy Your Own Home. Estimate your monthly mortgage payment.

Find A Lender That Offers Great Service. Web 28 of Gross Income. And you should make.

Web A QM for example has a total DTI ratio including the mortgage payments of 43 at the very most. Lock Your Rate Today. Ideally that means your monthly.

Were not including additional liabilities in estimating the. Even with this 43 threshold lenders generally require a more. With a Low Down Payment Option You Could Buy Your Own Home.

Web The amount of money you spend upfront to purchase a home. This rule says that you should not. One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule.

Web Non-housing expenses include debts such as car payments student loan payments alimony or child support. Web The 3545 Model. This rule says you.

Why Rent When You Could Own. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. Compare More Than Just Rates.

Web A 15-year term. Calculate Your Payment with 0 Down. See how much house you can afford.

Find A Lender That Offers Great Service. And they see a 28 DTI as an excellent one. Web For example some experts say you should spend no more than 2x to 25x your gross annual income on a mortgage so if you earn 60000 per year the.

The 28 rule isnt universal. NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. With a Low Down Payment Option You Could Buy Your Own Home.

A 20 down payment is ideal to lower your monthly. Comparisons Trusted by 55000000. Keep your total monthly debts including your mortgage.

This rule states you should limit your. Most home loans require a down payment of at least 3. Top backend limit rises to.

Get Instantly Matched With Your Ideal Mortgage Lender. Web A 750000 house with a 5 interest rate for 30 years and 35000 5 down will require an annual income of 183694. Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Highest Satisfaction for Mortgage Origination. Web 22 hours agoSome say to limit your monthly mortgage payment to 28 of your gross income while others use the 3545 model.

10 Best Home Loan Lenders Compared Reviewed. Principal interest taxes and insurance. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more.

Why Rent When You Could Own. Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Compare More Than Just Rates.

Keep your mortgage payment at 28 of your gross monthly income or lower. According to the FHA monthly mortgage payments. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term.

Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Apply Online To Enjoy A Service. Web The Bottom Line.

Some financial experts recommend other percentage models like the 3545 model. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. With a Low Down Payment Option You Could Buy Your Own Home.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

How Much House Can I Afford How The Math Works And Rule Of Thumb

What Percentage Of Income Should Go To Mortgage Morty

What Percentage Of Income Should Go To A Mortgage Bankrate

What Percentage Of Income Should Go To A Mortgage Bankrate

First Community Mortgage Home Facebook

How Much Of My Income Should Go Towards A Mortgage Payment

Debt To Income Ratio Formula Calculator Excel Template

Loan Vs Mortgage Top 7 Best Differences With Infographics

Mortgage Broker Taree Forster Better Loan Rates Mortgage Choice

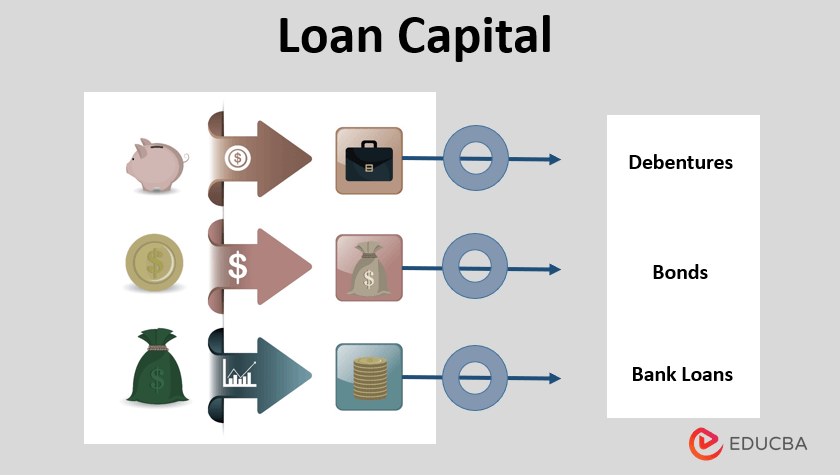

Loan Capital How To Find Loan Capital With Possible Sources

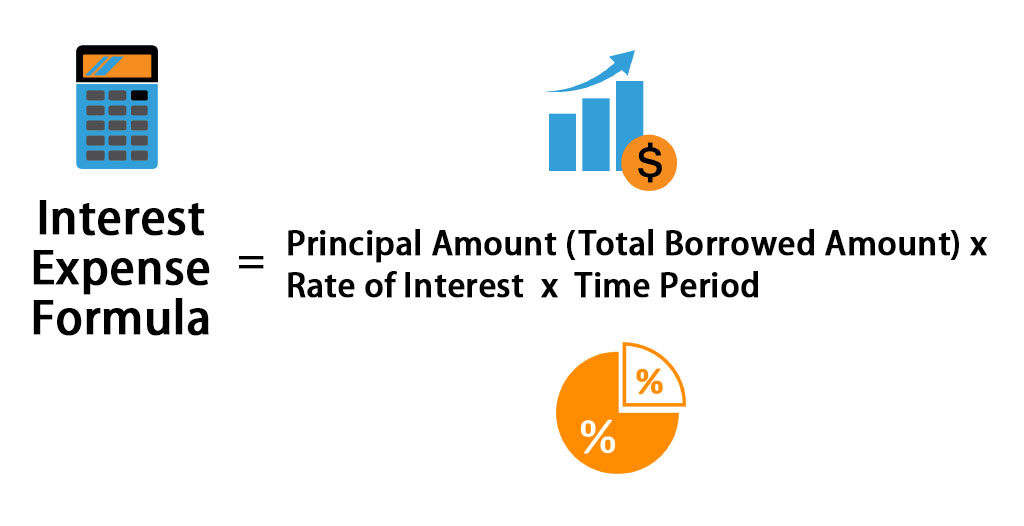

Interest Expense Formula Calculator Excel Template

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Of My Income Should Go Towards A Mortgage Payment

The Percentage Of Income Rule For Mortgages Rocket Money

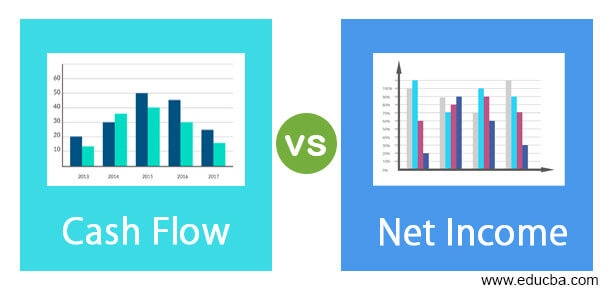

Cash Flow Vs Net Income Top 6 Differences To Learn

Percentage Of Income For Mortgage Payments Quicken Loans

Mortgage Banker Vs Broker Top 8 Difference To Learn With Infographics